Business Without Borders: How Multi-Currency Support Maximizes Software Sales Globally

Businesses aren’t limited by borders anymore. You can sell your products and services to people all over the globe, thanks to the internet. But dealing with different currencies can be tricky. That’s where multi-currency support comes in. It provides a critical advantage, allowing businesses to expand their reach and serve customers worldwide, regardless of currency differences.

Moreover, studies by Shopify show that 92% of shoppers prefer sites with prices in their local currency. That’s a massive chunk of potential customers who might be giving your software the side-eye because of confusing prices.

Even worse, 33% of people might just ditch their purchase entirely if they can’t figure out how much your software costs in their own money. That’s how important multi-currency support is for anyone doing online business.

In this blog post, we’ll explore how multi-currency support changes the game for software creators. Let’s start with the definition first.

What Is Multi-Currency Support?

Multi-currency support refers to the technology that can handle transactions and financial operations in multiple currencies. It allows businesses to conduct transactions, display prices, and manage finances in the currency of their choice, regardless of their location or the location of their customers.

Multi-currency support is essential for businesses operating in the global marketplace. It enables business owners to serve customers worldwide and navigate the complexities of cross-border commerce.

Benefits of Multi-Currency Support

Multi-currency support offers a range of advantages for businesses looking to expand internationally. Here are some key benefits:

Attract Customers Worldwide: By displaying prices in their preferred currency, you remove a barrier to entry for international customers. They’ll be more comfortable understanding pricing and completing purchases.

Morgan Stanley forecasts that the eCommerce market could reach $5.4 trillion in sales by 2026.

Multi-currency support can help you cater to the needs of worldwide customers and attract global customers.

Boost Conversion Rates: Currency confusion can lead to cart abandonment. Multi-currency support eliminates this frustration, increasing the likelihood of customers completing their transactions.

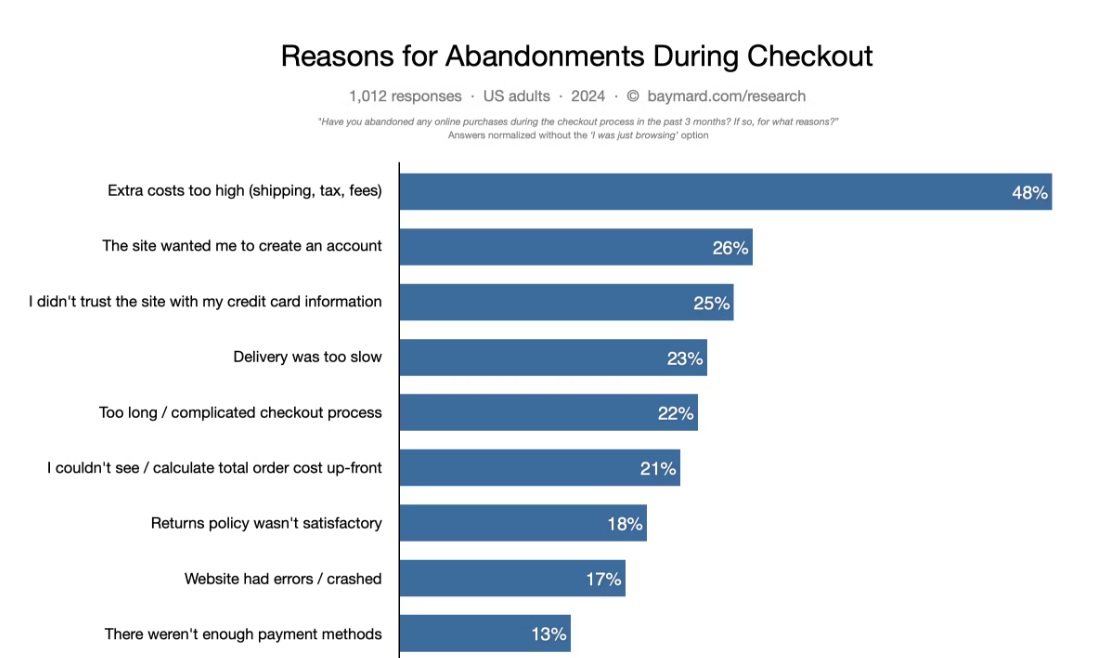

According to the Baymard Institute, here are the reasons for abandonments during cart and checkout (2024 data):

In addition to these statistics, a study reveals that around 13% of online shoppers abandon their shopping carts when they encounter prices listed in a foreign currency.

Seamless Checkout: Customers can pay in their familiar currency, making the checkout process smoother and more user-friendly. This builds trust and encourages repeat business.

Transparency and Trust: Displaying prices in different currencies fosters trust with international customers. They know exactly what they’re paying upfront. It also reduces the cart abandonment rate since 21% of customers leave carts if they can’t see or calculate the total order cost up-front.

Reach New Markets: Multi-currency support allows you to tap into a wider customer base across the globe. You’re no longer limited to customers who use your local currency.

Competitive Edge: By offering multi-currency support, you stand out from competitors who only accept one currency. This positions your business as more customer-centric and internationally focused.

Strategic Pricing: You can potentially tailor pricing for different regions based on local market trends and purchasing power.

Improved Brand Image: Multi-currency support demonstrates your commitment to international customers and positions your brand as a global player.

76% of shoppers prefer websites that list all products in their home currency when considering international purchases. Additionally, 19% of shoppers in Canada, the UK, and the US abandon digital shopping carts due to a lack of payment options.

– According to NetSuite’s report.

So, multi-currency support is a powerful tool for businesses looking to expand their reach, attract new customers, and increase sales in a global marketplace.

Also Read: How to Promote Your WordPress Products

Common Challenges of Multi-Currency Payments

Multi-currency support opens doors to exciting international markets, but it’s not without its hurdles. Here’s a deeper dive into the common challenges you might face:

1. Complexity Overload

Keeping track of exchange rates, conversion calculations, and individual transaction details for various currencies can be a time-consuming task. This can lead to errors in accounting and lost revenue.

If you sell physical products, managing stock levels across multiple currencies adds another layer of complexity. You’ll need to consider exchange rates when calculating product costs and setting prices in different regions.

2. Difficulties in Managing Cost

Payment processors charge fees for currency conversion. These can be a fixed percentage or a flat fee per transaction. For businesses with high transaction volumes, these fees can eat significantly into your profit margins.

The ever-changing nature of exchange rates can be a double-edged sword. While a favorable rate can boost your profits, an unfavorable swing can leave you with less than you anticipated.

Some payment processors may add a markup on top of the wholesale exchange rate. This hidden fee can significantly increase the cost of currency conversion. Be sure to compare pricing structures before choosing a provider.

Some processors have minimum fees for currency conversion, regardless of the transaction amount. This can disproportionately impact smaller transactions.

3. Technical Complexities

Implementing a multi-currency payment processing system often requires technical expertise. Integrating the new system may involve coding and configuration changes depending on your existing infrastructure.

4. Regulatory Compliance

Compliance with regulatory requirements related to currency exchange, taxation, and financial reporting can be complex and time-consuming for businesses operating in multiple currencies.

And, compatibility issues between your existing systems and the new payment processor can lead to delays and disruptions in your payment processing.

Moreover, financial regulations can vary significantly from country to country. You’ll need to ensure your business complies with relevant regulations in all the markets you operate in. Failing to do so can result in hefty fines and penalties.

5. Customer Confusion

Customers might not be familiar with exchange rates or how much they’ll pay in their own currency. This can lead to hesitation and abandoned purchases, ultimately leading to lost sales opportunities.

While multi-currency support offers numerous benefits, businesses must be aware of and address these common challenges to implement and leverage multi-currency payments successfully.

How to Implement Multi-Currency Support for Your Software

Expanding your software’s reach to a global audience is exciting! However, handling different currencies can add complexity. Here’s a breakdown of the key steps to implement multi-currency support for your software:

1. Research and Identify Supported Currencies

Research the currencies used by your target audience and determine which ones you want to support on your selling platform. Consider factors such as the geographic location of your customers, popular currencies in those regions, and potential expansion plans into new markets.

2. Choose Your Payment Processor

You don’t have to build everything from scratch! Partnering with a reputable payment processor simplifies the process. They handle currency conversions & transaction fees, including secure payments across borders. Look for processors offering features like:

- Support for a wide range of currencies

- Competitive exchange rates and transparent fees

- Integration options compatible with your selling platform

You can also implement currency conversion logic. Develop and integrate currency conversion logic into your selling platform to handle transactions in different currencies. Implement algorithms or APIs to calculate currency conversions based on exchange rates and transaction amounts.

3. Connect Your Selling Platform to the Payment Gateway

This might involve some technical work. The payment processor will provide documentation and tools to integrate their system with your platform. This allows for smooth communication and secure transactions.

Depending on your platform’s architecture, the complexity of integration can vary. Consider seeking help from developers if needed.

You can choose Appsero when selling WordPress products. Appsero integrates perfectly with FastSpring, which supports multiple currencies and enables them to be the selling platform.

4. Build a User-Friendly Interface

Make it easy for users to choose their preferred currency. This could be a dropdown menu, a flag selection, or a dedicated currency settings page within your software.

Clearly display prices in the chosen currency alongside the original price (e.g., $10 USD = €8.50 EUR). This provides transparency and avoids confusion.

5. Select the Type of Exchange Rate

You can choose from any of the two following exchange rates for your products:

- Live Rates: Prices automatically update based on current exchange rates. This offers transparency but can fluctuate slightly. (Think of it like constantly updating weather data.)

- Fixed Rates: Prices remain the same regardless of exchange rate changes. This provides stability for users but might not always reflect the exact value. (Imagine a fixed price tag in a store.)

Go for the approach that best aligns with your business model and user needs.

6. Stay Transparent to Your Customers

Be upfront about any transaction fees associated with currency conversion. Display the exchange rate used for calculations, especially if using live rates. This builds trust with your users.

7. Keep Testing and Testing

Before launching multi-currency support to your entire user base, thoroughly test it with a smaller group. This helps identify and fix any bugs or integration issues.

Bonus Tip: Consider offering a “price estimate” feature. This allows users to see a rough conversion in their preferred currency before they make a purchase.

By following these steps, you can equip your website to handle multiple currencies effectively. This opens doors to a global market and lets your software reach users worldwide!

Some Frequently Asked Questions About Multi-Currency Support

Here are the questions you may have in mind about multi-currency support for your products.

-

a. How does multi-currency support work?

Multi-currency support typically involves implementing currency conversion logic, updating user interfaces to display prices in different currencies, and finally, integrating payment gateways that support multi-currency transactions.

-

b. How do you handle currency conversion in multi-currency transactions?

Currency conversion in multi-currency transactions can be handled using real-time third-party APIs, fixed exchange rates, or manual updates based on exchange rate fluctuations.

-

c. What are some best practices for displaying multi-currency pricing?

Best practices for displaying multi-currency pricing include:

– Providing clear and consistent currency symbols and formats.

– Allowing users to select their preferred currency during the purchasing process.

– Displaying prices in multiple currencies simultaneously or providing real-time conversion options.

– Ensuring accuracy and transparency in pricing calculations. -

d. How do you ensure compliance and security in multi-currency transactions?

Compliance and security in multi-currency transactions involve implementing measures to protect sensitive financial data, prevent fraud, and comply with relevant financial regulations. This may include encryption, data privacy policies, and adherence to PCI DSS standards.

-

e. What documentation and support resources should be provided for multi-currency support?

You should include guidance on currency selection, conversion rates, payment methods, and troubleshooting common issues related to multi-currency transactions.

Unlock Global Growth with Multi-Currency Support

Imagine your software used by millions worldwide, no longer limited by currency barriers. That’s the potential of multi-currency support! You can overcome geographical restrictions and attract a wider customer base.

Multi-currency support is more than just a technical feature – it’s a strategic investment in your software’s future. We’ve provided a roadmap to help you implement multi-currency support for your software. Take the first step today and watch your software take center stage in the global market. With careful planning and the right tools, you can empower your software to conquer the world.

Subscribe To Our Newsletter

Don’t miss any updates of our new templates and extensions

and all the astonishing offers we bring for you.